The popularity of contactless payments has surged in recent years owing to the increase in spend limit as well as rapid expansion in places where such payment method can be used. In fact, recent analysis from Worldpay noted that contactless payments have become more popular than chip and pin card transactions for UK consumers.

Contactless payments have given consumers the convenience to pay for goods without having to use the chip and pin of the card. However, the inconvenience of contactless is that you can only use it if you’re purchasing for £30 or below in the UK, so for larger transactions you’d still need to use your PIN.

To enable a seamless and secure user experience, Gemalto introduced its first EMV card with fingerprint biometric with much higher limit on contactless payment transactions. Users are securely authenticated with their fingerprint and can enjoy the convenience of contactless for any amount. The convenience and security of biometric technology has led to its rapid adoption – for example since Apple introduced the Touch ID in 2013 we quickly became used to unlocking our devices with fingerprint. So why not have it on our bank cards as well?

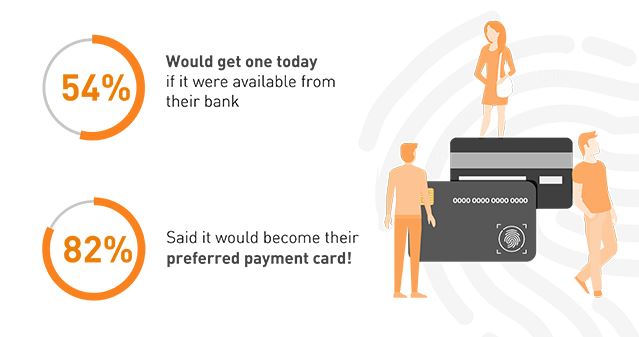

Since we launched the EMV biometric card in January 2018, we’ve seen incredible interest from banks to trial it. But to understand the wider perception of the card we recently commissioned a research with GFK to explore whether UK consumers are ready and willing to adopt the biometric card. 821 UK cardholders responded to our survey and the results have been very positive. A great majority (82%) thinks the new biometric payment card provides greater convenience and they suggested it would become their preferred payment card. Furthermore, a significant 86% perceive it to be more secure, as there’s no risk of someone stealing your PIN code.

More than half of UK consumers (54%) declared they’d use the biometric payment card if it was available from their bank today. If they’re to replace their chip and pin cards with biometric ones today, they would need them to be:

- More secure than what they currently have (88%)

- Offered by a trusted bank (79%)

- Easy to use (69%)

- Something that simplifies their lives (60%)

The biometric card matches these requirements and in fact, eight in ten consumers believe it will be better in terms of convenience and security because of its key advantages, which include:

- No need to remember different PIN codes

- More secure experience as there’s no risk of someone stealing your PIN

- More opportunities to pay contactless thanks to higher spending limits

- No limit on the number of transactions

However, some consumers are still concerned about biometric technology, with 41% worried that it won’t work all the time and 37% afraid that their fingerprint data could be compromised. Nevertheless, these concerns should be alleviated as consumers learn more about the technology. For example, biometric cards will be able to fall back to PIN code authentication if for any reason the fingerprint reader malfunctions. The fingerprint data is also securely stored in the card’s chip – not on the bank’s server and it never leaves the card.

We’ve addressed consumers’ concerns with the biometric payment card in this myth busting blog and this infographic.

You can also find more information on UK cardholders’ perceptions of the new card from our dedicated infographic.

What do you think about the new biometric payment card? Would you be willing to get one today if your bank offered it? Let us know in the comments below or by tweeting us @Gemalto.

The post UK consumers are ready to adopt the new biometric payment card appeared first on Cybersecurity Insiders.

November 21, 2018 at 09:10PM

0 comments:

Post a Comment